Succeeding in the restaurant business takes more than just mouthwatering dishes and efficient service. You also need impeccable restaurant cost management.

This guide is for any restaurant owner or manager who wants to keep restaurant expenses under control—without sacrificing customer service or employee morale. Discover the secret sauce to running a profitable restaurant.

Fixed Costs vs. Variable Costs vs. Semi Variable Costs

To properly manage restaurant costs, it can be helpful to understand if your most common restaurant expenses are fixed, variable or semi variable restaurant costs.

- Fixed costs do not change, regardless of sales

- Variable costs change according to sales

- Semi-variable costs may or may not change according to sales

Restaurant Operating Costs

Restaurant operating costs encompass the day-to-day expenses that are essential for keeping a restaurant running smoothly. These operating costs are the recurring fixed and variable costs that keep the doors open, the food and drink flowing, and the customers satisfied. 🥂

There are many operating costs restaurant owners need to manage carefully to maintain profitability.

Here’s a list of the most common restaurant operating costs that restaurants typically incur:

- Food and beverage: This variable cost is the amount spent on ingredients and drinks to prepare menu items.

- Labor: Wages (variable costs), salaries, and benefits (fixed costs) paid to front-of-house and back-of-house staff.

- Rent or mortgage: The fixed cost of occupying the physical space of the restaurant.

- Utilities: The variable costs of electricity, gas, water, and sewer services that keep the restaurant operational.

- Insurance: The fixed cost of the various types of insurance required to run a business, including liability, property, and worker’s compensation.

- Marketing and advertising: The marketing costs of promoting the restaurant to bring in customers. This amount can be a fixed or variable operating expense.

- Repairs and maintenance: Costs related to the upkeep of equipment, furniture, and the building to maintain a safe and pleasant environment. If you have a maintenance service plan, this would be a fixed cost. Unplanned repairs and maintenance are considered variable costs.

- Licenses and permits: Costs associated with maintaining legal compliance in operating a restaurant, such as business registration fees, liquor license fees, and food safety license fees. These are generally fixed costs.

- Supplies: Non-food items necessary for service, such as napkins, cleaning materials, and to-go containers. This amount may be more of a semi-variable cost that may vary slightly according to output.

- Credit card processing fees: Payment processing fees are the amounts paid to credit card companies for processing customer payments. Average credit card processing fees range from 1.5% to 3.5%, making it a variable cost based on total sales.

Restaurant Startup Costs

Restaurant startup costs are the initial investments required to open a new restaurant. These expenses include everything from securing a location to outfitting the kitchen with equipment.

These one-time costs are essential for building a successful restaurant, and they often require a substantial amount of capital upfront. Being thorough in the planning phase can help new restaurateurs prepare for these restaurant expenses, save money, and avoid unexpected financial challenges.

Here’s a list of necessary startup costs that new restaurant owners typically face:

- Construction costs: Building the new restaurant.

- Leasehold improvements: Renovating and decorating the space to suit the restaurant’s theme.

- Kitchen equipment: Industrial stoves, ovens, refrigerators, freezers, and dishwashers.

- Dining room furnishings: Tables, chairs, bar stools, and décor.

- Initial food and beverage inventory: Purchasing the first round of ingredients and drinks.

- Operating capital: Funds to cover initial operating costs before the restaurant starts generating profit.

- Point of sale system and other restaurant software: Technology for order taking, billing, and sales tracking.

- Licenses and permits: Fees for obtaining various business licenses and health department permits.

- Marketing and advertising: Costs associated with promoting the grand opening and initial operations.

- Signage: Exterior and interior signs, menus.

- Uniforms: Apparel for both FOH and BOH staff, if required.

- Professional services: Fees for attorneys, accountants, and consultants.

- Insurance: Coverage for property, liability, workers’ compensation, and other potential risks.

Main Costs Involved in Running a Restaurant

Labor Costs

Labor costs in a restaurant include hourly wages, salaries, overtime, employee benefits, and payroll taxes associated with employing staff. These ongoing operating costs recur monthly, making them one of the largest and most complex expenses to manage.

The average labor cost percentage for a restaurant is around 30% of total revenue. Anything between 20 and 30% is considered acceptable. Above 30% is high, below 20% isn’t realistic.

How to calculate restaurant labor costs

To calculate total labor costs, you need to add up all the wages you pay to your employees, plus the taxes and benefits that accrue on those wages.

How to reduce restaurant labor costs

Most restaurants can find ways to reduce labor costs without having to harm customer service or employee satisfaction.

- Hire the right people: Hire the best restaurant workers you can. Experience is good, but positivity and enthusiasm are even better because these essential qualities for restaurant staff cannot be taught.

- Invest in your team: Good employee onboarding and training will help reduce employee turnover, improve customer service, and increase profitability.

- Optimize scheduling: Use scheduling software or a restaurant work schedule template to match staff schedules with customer traffic patterns and avoid overstaffing during slow periods.

- Provide cross-training: Train employees in multiple roles to maximize flexibility and efficiency.

- Create a positive work environment: The Center for Hospitality Research at Cornell University found that the average cost of losing a front-line restaurant employee is $5,864. Creating a healthy culture will make it easier to manage restaurant staff, lower turnover, and keep labor costs low.

Food Costs

Food costs refer to the money spent on ingredients used to prepare the dishes on the menu. Food cost is a variable cost that can change monthly, depending on things like fluctuating food prices and wastage.

Most restaurant owners and operators aim to keep food costs between 28 and 35% of total sales to be profitable.

How to calculate restaurant food costs

To calculate food costs, track the cost of ingredients purchased and compare it to the revenue generated from selling dishes made from those ingredients.

How to reduce restaurant food costs

Here’s how to reduce restaurant food costs without sacrificing customer service or employee satisfaction.

- Monitor portion control: Ensure consistent portion sizes to avoid waste and ensure cost consistency.

- Negotiate with suppliers: Build relationships with suppliers to secure better prices or discounts for bulk purchases.

- Do regular inventory management: Perform regular inventory checks to prevent over-ordering and to monitor for waste or theft.

- Use the first in, first out (FIFO) method: Always using the oldest food first will prevent food from expiring and having to be thrown out.

- Offer daily specials: This is an easy way to avoid wasting food nearing the expiry date and add more variety to your menu.

- Keep staff informed: Train back-of-house staff on how to avoid waste during food prep, and train front-of-house staff on which dishes are most profitable. Improving communication with staff will help keep everyone in the loop.

- Create a profitable menu: Good menu engineering can raise a restaurant’s profits by 10 to 15%.

Rent

Rent is a fixed cost for the use of the property where the restaurant operates. Typically, rent is a monthly expense, but it can also be subject to annual increases based on the terms of the lease.

As a rule, most restaurants should aim to keep total occupancy cost (rent, property taxes, insurance, etc.) under 10% of gross sales, although this can vary based on several factors. Analyzing the sales and occupancy costs for your competitors may be a better benchmark.

How to weigh restaurant rent costs against potential income

Weighing rent costs against potential income in a restaurant business is a critical aspect of financial planning. This can be approached through a process known as a rent-to-sales ratio analysis. This ratio helps you determine the affordability of your rent based on the projected sales of your restaurant.

Here is how you can analyze and weigh rent costs against potential income:

Rent-to-sales ratio:

- The rent-to-sales ratio is calculated by dividing the monthly rent cost by the monthly gross sales and then multiplying by 100 to get a percentage.

- For example, if your rent is $5,000 per month and your gross sales are $50,000, your rent-to-sales ratio is (5,000/50,000) * 100 = 10%.

Industry benchmarks:

- Compare your calculated ratio to industry benchmarks. A common benchmark for restaurants is to keep the rent-to-sales ratio between 5% to 8%, though this can vary based on factors such as location and restaurant type.

- Ratios higher than the benchmark suggest that the rent may be too expensive for the expected sales volume, while lower ratios indicate a more favorable cost structure.

Projected sales:

- Estimate your potential income conservatively, based on market research, location, concept, and size. Consider the best, average, and worst-case scenarios.

- Your rent should be affordable even in the average to worst-case sales scenarios to protect your business from unforeseen downturns.

Additional costs:

- Consider that rent is only one part of your occupancy costs. Additional costs may include utilities, taxes, insurance, and common area maintenance (CAM) fees.

- Make sure to add these costs to your rent when calculating your total occupancy cost-to-sales ratio.

Cash flow:

- Look at your detailed financial projections and cash flow analysis to ensure you can afford the rent even when other variable costs fluctuate.

Location vs. rent cost:

- Higher rent for a prime location could be justified by higher expected sales due to increased foot traffic or the demographic of the area.

- Conversely, a lower rent in a less desirable location might mean you will have to work harder and spend more on marketing to achieve the same level of sales.

Lease terms:

- Negotiate lease terms that can provide some relief during the initial stages of the business, such as a graduated rent increase or a percentage rent agreement where the rent is tied to the sales volume.

Utilities

Utilities are the costs of services such as electricity, gas, water, and sewage required to operate a restaurant. These are ongoing expenses that are typically billed monthly.

Energy costs are typically 3 to 5% of sales for the average restaurant, which pays approximately $0.11/kWh for electricity and $1.05/therm for natural gas.

How to calculate restaurant utility costs

Utilities are calculated by metered usage; therefore, your monthly bill reflects the actual consumption of these services.

How to reduce restaurant utility costs

There are a few ways to reduce utility costs that will not harm customer experience.

- Turn it down: Set your HVAC unit to 78 degrees during the warm season and 68 degrees in the cool season. Set your water heater to 120 degrees, but no lower to prevent bacterial growth in the water tank.

- Invest in energy-efficient appliances: They use less electricity and water, leading to lower bills.

- Perform regular maintenance: Ensure all equipment is serviced regularly to maintain efficiency.

- Educate staff: Train staff to turn off lights and equipment when not in use and to be mindful of water usage.

- Install accessories like automatic door closers and strip curtains to trap in walk-in’s refrigerated air during deliveries.

- Don’t over-tax refrigerators: Use ice baths or other cooling techniques to quickly cool hot food before putting them in your reach-ins.

- Check for water leaks: Not all water leaks are visible, but chances are you will notice a higher water bill if you have one. Check your water bills for recent years; if your water consumption seems to be going up for no obvious reason, have the water company come and do an inspection,

- Light with LED: Swap out incandescent for LED lighting, which is 75% more efficient.

- Take advantage of time-of-use (TOU) rates: Choose off-peak hours to run equipment like clothes washers for your uniforms.

- Go electric: Gas may be the preferred cooking method, but today’s modern electric appliances like infrared ovens and clamshell grills can reduce cooking times by as much as 25%, saving energy while getting your food out faster.

Technology

Key software for restaurants

Investing in the right technology can significantly lower ongoing operating costs. It will help to streamline operations, enhance the customer experience, and provide valuable data insights, leading to cost savings and increased profitability in the long run.

Technology costs in a restaurant involve the acquisition, operation, and maintenance of various digital systems and tools essential for modern operations. These costs can be both one-off (like the initial purchase of hardware and software) and recurring monthly or annual fees for subscriptions and support services.

Here’s a list of essential technology tools that a restaurant can utilize to run their business more efficiently:

- Point-of-sale (POS) system: Used to track sales, inventory, and customer data.

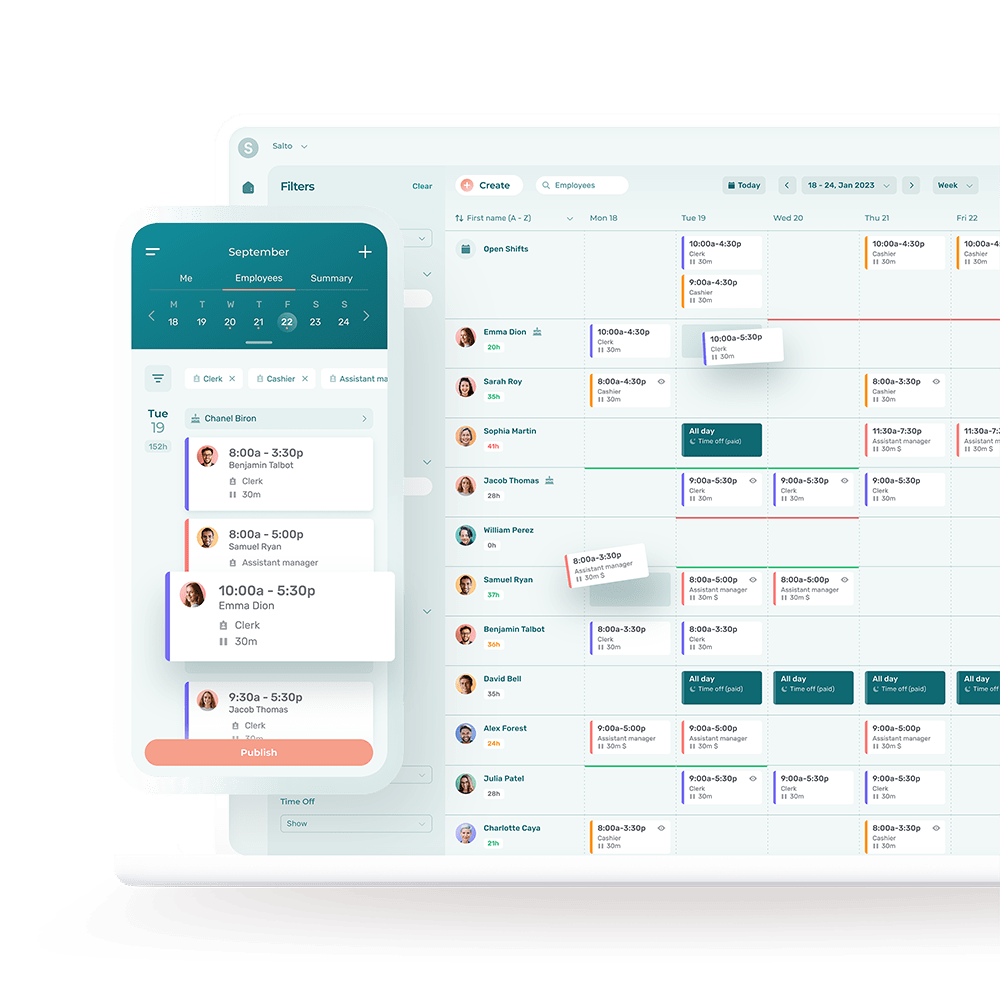

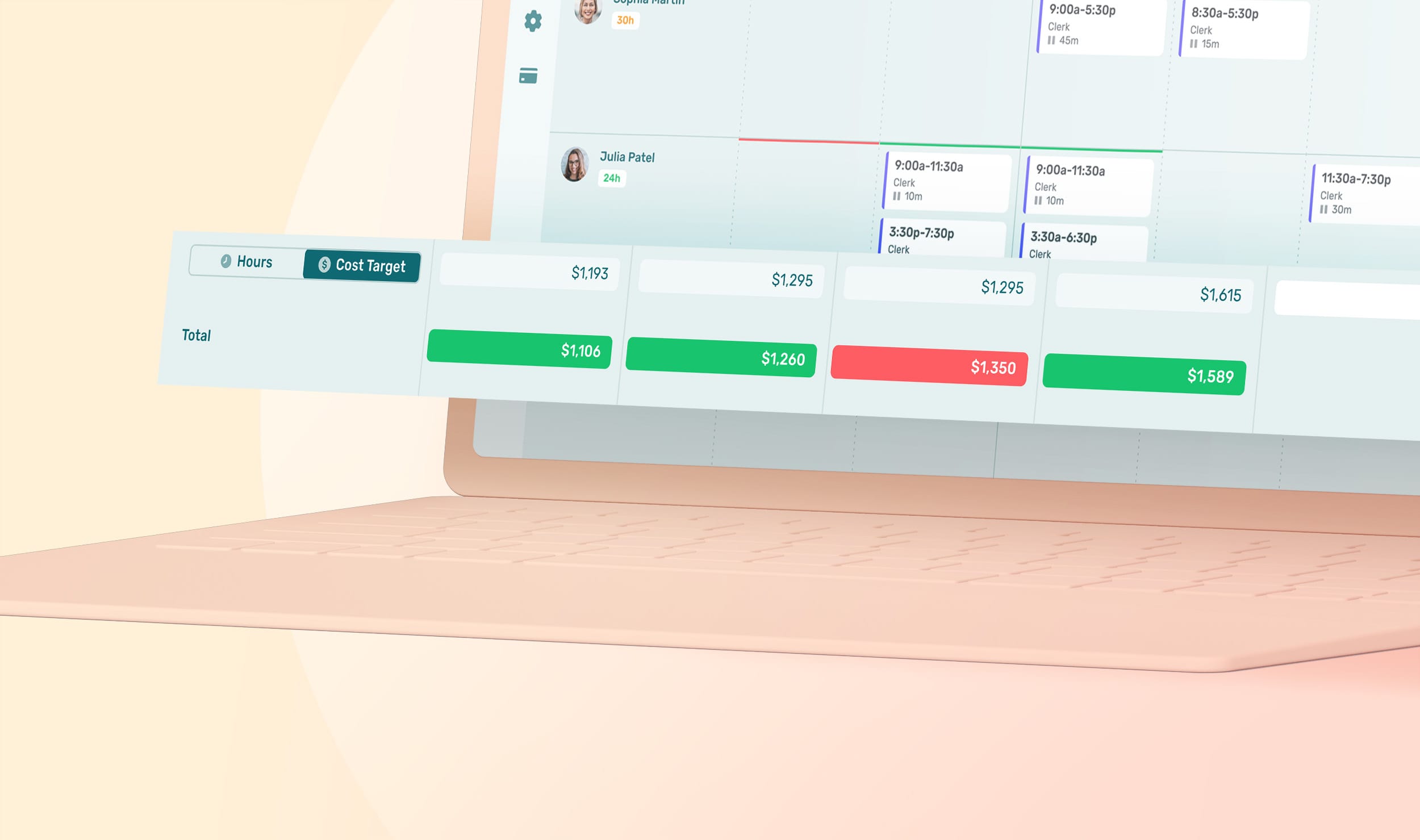

- Scheduling software: Used to optimize staff scheduling and reduce labor costs.

- Inventory management software: Used to track inventory in real-time, helping to reduce waste and food costs.

- Reservation and table management system: Used to manage reservations and dining room flow to enhance the customer experience.

- Digital ordering platforms: Used to take online orders.

- Customer relationship management (CRM) system: Used to build customer loyalty through personalized marketing and service.

- Employee training platforms: Used to standardize and streamline employee training, leading to better employee retention.

- Financial management software: Used to handle day-to-day bookkeeping and monitor the restaurant’s financial health.

- Energy management systems: Used to monitor and control energy usage in the restaurant to save on utility costs.

- Security software: Used to protect customer data and payment information.

- Wi-Fi and connectivity solutions: Used to ensure reliable internet access for the restaurant, staff, and customers.

How to calculate restaurant technology costs

Calculating technology costs requires tallying up the price of hardware, software licenses, and any ongoing support or subscription services.

How to manage restaurant technology costs

Since technology helps restaurants decrease the cost of goods sold and operational expenses, the goal is not to minimize technology costs but rather to maximize return on investment. Here are some strategies for doing this:

- Prioritize needs: Invest in technology that offers the highest return on investment by improving efficiency or customer experience.

- Bundle services: Look for bundle deals from vendors who can provide multiple services at a discount.

- Regularly review subscriptions: Ensure you are not paying for software or services that are underutilized.

Equipment

Equipment costs for a restaurant encompass the purchase price of all the machinery and tools required for food preparation, cooking, storage, and service. These are typically one-off costs, but they can recur if equipment needs to be replaced or updated. Some equipment may also have associated financing costs if not paid in full upfront.

How to calculate restaurant equipment costs

Below is a list of typical equipment needs for a restaurant, along with their approximate price ranges. The price range for equipment can vary significantly based on whether you choose entry-level, mid-range, or high-end options.

To calculate equipment costs, you should consider the purchase price of each item, including delivery, installation and maintenance fees.

- Refrigeration units: From small under-counter fridges at $1,000 to walk-in coolers upwards of $10,000.

- Ovens: Commercial ovens can range from $5,000 for a basic model to over $30,000 for advanced or specialized units.

- Grills: $1,000 for a small commercial grill to over $10,000 for large, high-end models.

- Deep fryers: Around $500 – $5,000, with price varying by capacity and features.

- Dishwashers: $4,000 – $15,000, depending on the type (under-counter, door type, or conveyor).

- Food processors: $200 – $2,000 for commercial-grade processors.

- Mixers: Stand mixers can cost from $500 for a small unit to $20,000 for a large industrial mixer.

- Safety equipment: Including fire extinguishers and suppression systems, can range from $100 to several thousand dollars.

- Shelving units: $100 – $1,000+ for robust commercial shelving.

- Cookware and utensils: The collective cost can range from $1,000 to $5,000+ depending on the quality and quantity.

- Furniture: Depending on style and quality, costs can range from $50 per chair to $200 or more, and tables can range from $100 to $1,000 each.

How to lower restaurant equipment costs

There are a few strategies for reducing restaurant equipment costs over the short and long run.

- Buy versatile equipment: Opt for multi-purpose equipment that can perform various functions, reducing the need to purchase additional items.

- Check out auctions: Second-hand restaurant equipment or restaurant auctions can provide substantial savings, especially for new establishments working with a tighter budget.

- Consider leasing: Leasing equipment can reduce initial outlay and include maintenance.

- Maintain regularly: Instituting a regular maintenance schedule can extend the life of equipment and prevent costly repairs.

Streamline Restaurant Management and Operations

There are many critical ‘Jobs to Be Done’ in the restaurant industry. Optimizing staffing and labor costs is one critical job that can help keep restaurant monthly expenses in check.

Agendrix restaurant employee scheduling and management software is the no-nonsense way to make scheduling more efficient in your restaurant. Its user-friendly interface makes it easy to create and communicate staff schedules that adjust to customer traffic patterns to avoid overstaffing.

The analytics in Agendrix schedule software can help further lower total labor costs by identifying staffing inefficiencies and by reducing the time managers spend on scheduling by up to 80%, allowing them to focus on other cost-saving initiatives within the restaurant.

Agendrix integrates seamlessly with other systems, making it a powerful ally for restaurant managers aiming to streamline operations and cut unnecessary expenses. What’s more, it can help restaurateurs comply with labor laws—another way to lower restaurant costs.

Secret Sauce for a Profitable Restaurant

- Choose a location and menu designed around profitability

- Invest in multi-functional equipment and maintain it diligently

- Build the best possible team and create a great work environment to retain quality talent

- Focus on minimizing waste (food, energy, supplies, effort)

- Leverage technology to improve the customer experience and minimize operating costs

- Know your clientele and promote your business on the channels they frequent