Do you know how much revenue your restaurant makes each week? Your monthly net profit? When running a restaurant, mastering the art of bookkeeping can make all the difference between profit and loss.

Take a quick dive into the essentials of restaurant accounting—from the different accounting methods to managing restaurant income and expenses. Discover the key restaurant costs and the tools you can use to improve your restaurant’s financial health.

Key Takeaways

- Restaurant accounting involves tracking financial activities, including transactions, restaurant expenses, payroll deductions, and financial statements.

- Restaurants can use two types of accounting methods, cash or accrual, depending on their needs and the complexity of operations.

- The restaurant industry must track several restaurant costs, including food and beverage costs, labor, rent/mortgage, utilities, supplies, maintenance, marketing, and more.

- Key elements in bookkeeping to track include the cost of Goods Sold (COGS), labor costs, payroll accounting, prime cost, and cost-to-sales ratio.

- There are a number of key steps restaurants must diligently follow for effective bookkeeping. These range from setting financial goals and KPIs, to tracking daily transactions.

- There are a number of easy to use restaurant accounting software options that will streamline these routine restaurant accounting tasks. It will also make it easier to prepare financial reports such as your monthly profit and loss statements.

- Some restaurant business owners may want to delegate these important but time consuming tasks to an accounting firm specializing in restaurant accounting services.

What Is Restaurant Accounting?

Restaurant accounting is the practice of managing and tracking a restaurant’s financial activities. In the restaurant industry, this goes beyond simple bookkeeping such as tracking financial transactions. It also includes monitoring restaurant expenses, managing payroll, and preparing financial reports such as profit and loss statements.

Accurate restaurant accounting helps owners and managers understand their organization’s financial health, optimize costs, and identify opportunities for further profitability and growth. This is vital in the restaurant industry where the average gross profit margin is roughly 5%, but labor costs eat up approximately 33% of total revenue.

Do All Restaurants Need to Have a Chart of Accounts?

All restaurants, regardless of size or type, need to have a chart of accounts. The chart of accounts is a fundamental accounting tool, serving as a comprehensive listing of every account in a restaurant accounting system. Consider it a sort of financial organizational chart.

Having a chart of accounts is critical for several reasons:

1. Financial Organization

A chart of accounts categorizes all transactions into understandable and manageable groups. This helps in organizing financial information efficiently, which is crucial for a detail-oriented business like a restaurant.

2. Financial Reporting

A chart of accounts will make sure revenue and expenses are categorized in a consistent way. This will aid in preparing essential financial statements like the balance sheet and income statement.

3. Budgeting and Forecasting

A chart of accounts provides restaurant owners and managers a clear view of the restaurant’s various financial areas, making it easier to forecast sales and budget expenses. It also helps them understand how money flows into and out of each account so that they can improve financial planning.

4. Regulatory Compliance

A well-maintained chart of accounts will ensure the restaurant’s compliance with restaurant accounting standards and tax laws. It will also simplify the process of reporting revenue and expenses for tax purposes.

5. Performance Analysis

A chart of accounts enables a more detailed analysis of the restaurant’s financial performance. By segregating expenses, revenues, assets, and liabilities, owners can pinpoint areas of strength and those needing improvement.

6. Scaling and Growth

As a restaurant grows, its financial complexity increases. A chart of accounts can scale with the business, accommodating new revenue streams, expense categories, or locations.

Restaurant Accounting Methods

There are different types of restaurant accounting methods, each with its own benefits and suitability depending on the size and nature of the restaurant. Two fundamental accounting systems used by restaurants are cash accounting and accrual accounting.

Cash Accounting

Cash accounting is a straightforward accounting method where revenues and expenses are recognized only when cash is received or paid.

- Benefits

- Simplicity and ease of understanding.

- Accurate real time portrait of cash flow.

- Less time-consuming in terms of bookkeeping.

- Best for

- Small restaurants, especially those that operate on a cash basis (no credit card transactions, lines of credit, etc.) or that have a simple business model.

- Establishments without significant food and beverage inventory or those that do not offer credit to customers.

- Restaurant owners who prefer a clear, real-time picture of how much cash they have on hand.

Accrual Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of when the cash transaction occurs.

- Benefits

- Provides a more accurate picture of financial health over time.

- Recognizes accounts payable and receivable, offering a comprehensive view of finances.

- More complex and requires a deeper understanding of accounting principles.

- Best for

- Larger restaurants or chains with more complex operations.

- Establishments with significant inventory, credit card sales, or those dealing with suppliers on credit terms.

- Restaurants looking to expand or needing detailed financial records for investors or loans.

Which Accounting Method to Choose?

Ultimately, the choice between cash accounting and accrual accounting depends on the restaurant’s specific needs and the complexity of revenues and operating expenses. Your choice of accounting systems should also be based on your future plans.

- Small or simple restaurants: Cash accounting is often preferred due to its simplicity and real-time reflection of cash flow. This makes it easier for restaurant owners with little time or accounting know-how to track and manage finances.

- Larger or more complex restaurants: Accrual accounting is advantageous as it offers a more accurate long-term view of the restaurant’s financial health. This view is essential for growth, planning, and attracting investors.

Essentially, most smaller establishments with simple operating expenses and restaurant bookkeeping will benefit from the straightforward nature of the cash accounting system.

On the other hand, larger or growth-oriented restaurants with complex operating expenses and restaurant bookkeeping may require comprehensive real time insights into revenue and expenses, which are better provided by the accrual accounting system.

What You Need to Keep Track Of

There are a number of variable and fixed costs that restaurant owners need to keep a close eye on.

Cost of Goods Sold

The cost of goods sold (or COGS) is the total cost of all the ingredients and food items that a restaurant sells to its customers.

How to calculate COGS

Add the beginning inventory to the purchases made during the period, then subtract the ending inventory.

Best practices for lowering the cost of goods sold

- Regularly track inventory to ensure accurate calculations.

- Monitor fluctuations in ingredient prices to manage COGS effectively.

- Use restaurant inventory management software to reduce food costs and waste, lower COGS, improve vendor management, automatically renew inventory, and more.

Labor Costs

Labor costs include all expenses related to compensating employees, including wages, salaries, and benefits.

How to calculate labor costs

Add up all payments to employees, including hourly wages, salaries, overtime, and additional benefits.

Best practices for lowering labor costs

- Schedule staff efficiently to manage labor costs.

- Consider labor costs in pricing and budgeting decisions.

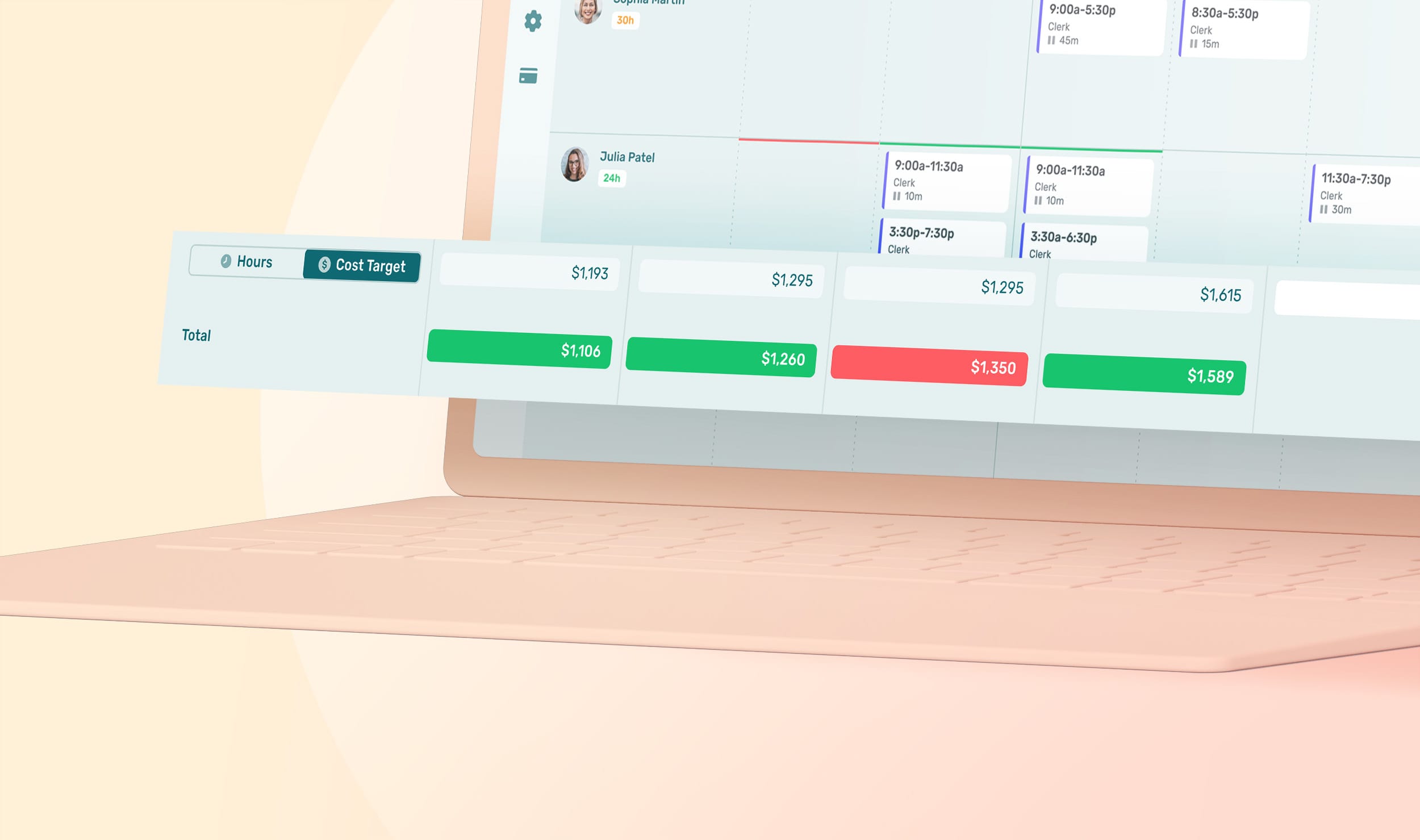

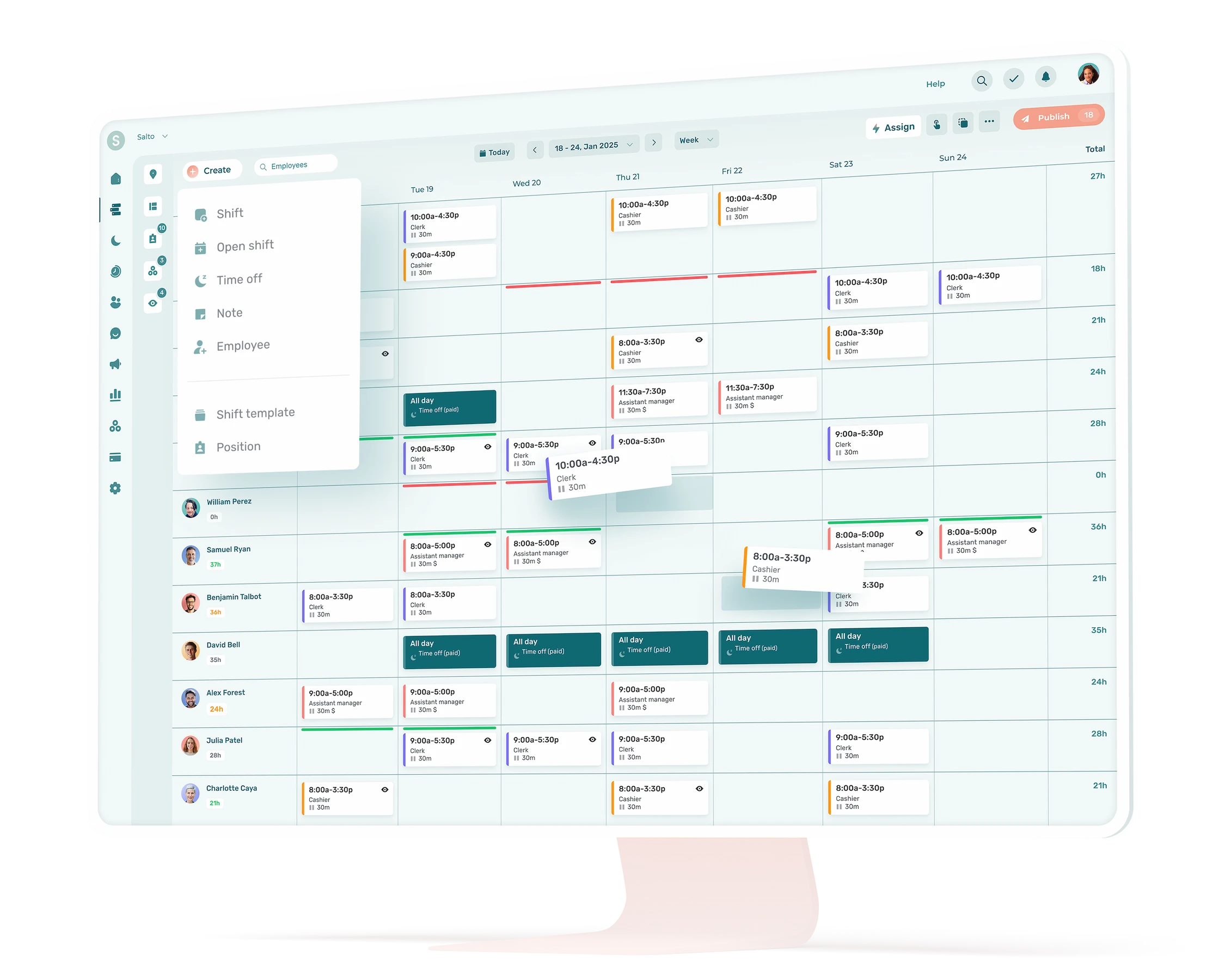

- Use restaurant employee scheduling and management software to lower labor costs, streamline the scheduling process, reduce errors, and improve communication between management and staff.

See how one of Montreal’s top rated restaurants improved scheduling and communication among its 100+ restaurant employees. So long endless hours spent each week on creating schedules, tracking timesheets and communicating scheduling changes.

Looking for free tools to simplify restaurant cost tracking? Visit our restaurant management templates page for a complete list of downloadable resources.

Labor + COGS = Prime Cost

Adding your labor costs and costs of goods sold gives you the restaurant’s prime cost. This is another key cost to track as it represents the bulk of the restaurant’s operating expenses—essential for interpreting financial data.

Payroll Accounting

Payroll accounting is an accounting process that focuses solely on employee-related expenses. These expenses include salaries and wages, the costs of benefits and paid time off as well as payroll taxes.

How to improve payroll accounting

Payroll accounting encompasses several recurring tasks such as tracking employee hours, managing tips, handling withholdings, and processing payroll taxes. These tasks can be done much more efficiently with the right restaurant accounting software.

Ways to track employee hours

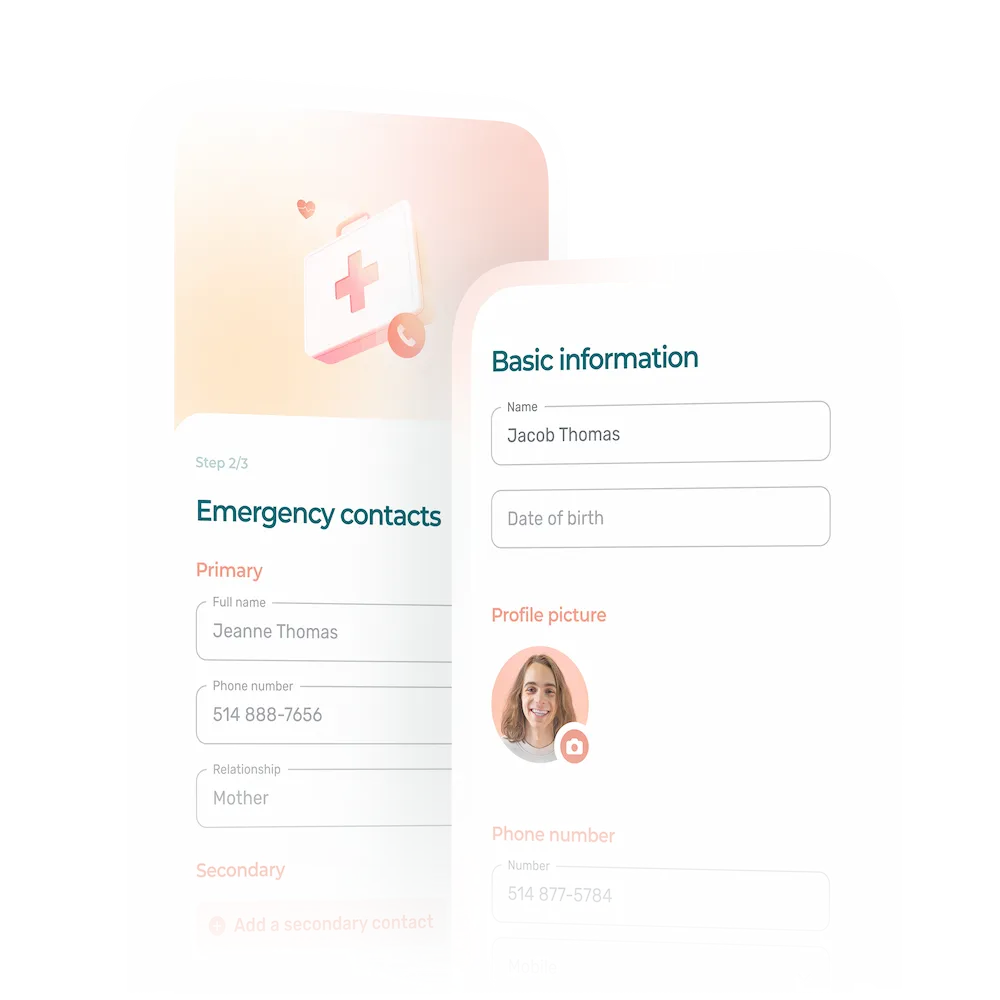

Digital timekeeping system: Implement digital time clocks or timekeeping software where employees can clock in and out. These systems accurately record hours worked, including overtime, and can often integrate directly with payroll systems. Some employee scheduling and management software, like Agendrix, includes timekeeping features and syncs with payroll software to reduce the number of software solutions you need to manage. The time and attendance employee tracking feature in Agendrix can turn any device—tablet, smartphone, or computer—into a punch clock.

Regular audit: Conduct regular audits of time records to make sure reported work hours are accurate and to prevent discrepancies or time theft.

Ways to manage tips

Clear tip policy: Establish a clear, written policy on how tips are distributed (individual or pooled) and how they are reported for tax purposes.

Tip tracking software: Utilize software that allows employees to report tips at the end of their shift. This ensures accurate reporting and easier management of tip distribution.

Ways to handle withholdings

Payroll software: Modern payroll software vastly simplifies payroll by automatically calculating amounts like bi-weekly pay and payroll deductions such as federal, state, and local taxes, Social Security, Medicare, health insurance, or retirement contributions.

Stay informed: Regularly update your knowledge about tax laws and withholding requirements to ensure compliance.

Ways to process payroll

Automated payroll services: Hire an automated payroll service, which will calculate gross pay, deduct appropriate withholdings, and issue net pay to employees.

Integrate payroll with timekeeping: Ensure the payroll system integrates seamlessly with your timekeeping system (or with your employee scheduling and management system, if you’re using a full-featured solution like Agendrix) for accurate wage calculations.

Regular updates and audits: Keep the payroll system updated with current tax rates and legal requirements. Conduct periodic audits to ensure accuracy and compliance.

Best practices for managing payroll accounting

- Ensure accurate payroll records for legal compliance.

- Use restaurant payroll software to speed up payroll and onboarding tasks.

Simplify your restaurant scheduling by managing availability, time off, and shift swaps with ease. Agendrix restaurant employee scheduling and management software is easy to use and integrates with your other systems to improve efficiency across the board.

14 Steps to Accurate Restaurant Bookkeeping

To maintain effective bookkeeping, restaurant managers should follow a structured process. Here’s a list of specific steps to guide this essential task:

1. Set Financial Goals and KPIs (Key Performance Indicators)

- Determine short-term and long-term financial goals.

- Identify key KPIs like revenue growth, profit margins, cost of goods sold (COGS), labor cost percentage, and prime cost.

2. Organize Financial Documents

- Keep all financial documents such as receipts, invoices, bank statements, and payroll records organized and accessible.

- Consider using digital tools or cloud storage for better organization and backup.

3. Implement a Reliable Accounting System

- Choose an accounting software that’s suitable for restaurant operations.

- Ensure the system can track sales, expenses, inventory, and payroll efficiently.

4. Record Transactions Daily

- Record all sales and expenses daily for accurate financial tracking.

- Regularly update inventory records to reflect current stock levels.

5. Manage Cash Flow

- Monitor daily cash flow to understand your restaurant’s financial health.

- Regularly reconcile bank statements with your records.

6. Handle Payroll and Employee Financial Management

- Process payroll accurately and on time.

- Keep track of employee hours, manage tips accurately, and handle tax withholdings.

7. Track and Analyze Key Metrics

- Regularly review KPIs to understand performance.

- Compare current financial data with past periods to identify trends and areas for improvement.

8. Manage Accounts Payable and Receivable

- Keep track of money owed to suppliers and money owed by customers (if applicable).

- Ensure timely payments to maintain good relationships with vendors.

9. Prepare Monthly Financial Statements

- Generate income statements, balance sheets, and cash flow statements monthly.

- Review these statements to gain timely insights into the restaurant’s financial performance.

10. Budget and Forecast

- Create a budget based on historical financial data and future projections.

- Use this budget to guide spending and investment decisions.

11. Regularly Review and Adjust Prices

- Analyze menu item profitability and adjust pricing as necessary.

- Consider market trends, ingredient costs, and demand in pricing decisions.

12. Manage Tax Planning and Compliance

- Stay updated with tax laws to ensure compliance.

- Plan for tax payments and file returns on time.

13. Create a Comprehensive Financial Report

- Compile a detailed report summarizing financial performance.

- Include insights, trends, and areas of concern or opportunity.

14. Consult With a Financial Expert Regularly

- Regularly consult with an accountant or financial advisor for expert advice and guidance.

- Use their insights for strategic financial planning and to address complex financial issues.

Optimizing employee management is a key step in improving restaurant profitability. See why thousands of restaurants rely on Agendrix Restaurant Scheduling Software.

3 Best Restaurant Accounting Software in Canada

A quick internet search will turn up a wide variety of restaurant accounting software. The trick is finding the right restaurant accounting software—such as a cloud based solution designed expressly for restaurant specific needs.

This guide to restaurant accounting offers three highly regarded and easy to use options.

1. Restaurant365

Key Features:

- Best overall restaurant accounting software

- Above-average reporting

- Above-average analytics

Free Trial Available: No

Star Rating: Not available

2. QuickBooks Online

Key Features:

- Best for reporting capabilities

- Above-average direct deposit payroll

- Above-average income and expense accounting

Free Trial Available: 30-day free trial

Star Rating: 4.0/5

3. Xero

Key Features:

- Best for low price, rich features

- Above-average income and expenses accounting

- Above-average file exporting

Free Trial Available: 30-day free trial

Star Rating: 4.3/5

Do Restaurants Have Accounts Payable?

Yes, restaurants have accounts payable. Accounts payable refers to the money a business owes to its suppliers or vendors for goods and services received but not yet paid for.

In the case of restaurants, this includes payments for food and beverage supplies, kitchen equipment, and other necessary services like utilities and maintenance. Managing accounts payable is crucial for maintaining good relationships with suppliers and ensuring a steady supply of ingredients and other essentials for daily operations.

Are Restaurants Cash or Accrual?

Restaurants can use either the cash or accrual accounting method, though the choice often depends on the size and complexity of the business.

- Smaller restaurants or those just starting out may prefer cash accounting due to its simplicity and straightforwardness, as it records transactions only when cash changes hands.

- Larger restaurants, especially those with more complex operations, inventory management, and credit card transactions, often opt for accrual accounting. This method records revenues and expenses when they are earned or incurred, regardless of when the cash transaction occurs, providing a more accurate financial picture over time.

How Do Restaurants Track Expenses?

To track expenses, restaurants typically use accounting software that categorizes and records all financial transactions. This software can track various expenses, including food costs, beverage costs, fixed costs, cost of supplies, labor costs, utilities, rent, and others.

Some systems offer integration with inventory management and point-of-sale (POS) systems, allowing for real-time tracking of expenses against sales revenue. By regularly reviewing expense reports, restaurant managers can better identify areas where cost savings can be made, thereby improving their budgeting and financial planning.