Read our complete minimum wage guide for tips on how to recruit, retain & pay minimum wage workers in Canada.

Key Takeaways:

- Minimum wage rates and laws vary by province and territory; sometimes by job and employee age category as well.

- The federal minimum wage in Canada only applies to employees working in federally-regulated industries such as, banks, postal services and other Crown corporations

- All employers must respect minimum wage legislation and the employment standards act.

- Being transparent about pay can actually be beneficial – even for low paying jobs. In some places, it’s now mandatory.

- Wage is not the only way to attract and retain quality employees; workers are increasingly focusing on total compensation.

- There are specific things businesses owners can do to make minimum wage jobs more appealing to jobseekers.

What Is Minimum Wage?

Minimum wage is the lowest hourly rate employers can legally pay employees. It was established to prevent the exploitation of workers and to guarantee they receive fair compensation for their work.

In Canada, each province and territory sets its own minimum wage legislation, taking into consideration factors like cost of living and economic conditions. These laws aim to promote decent living standards and economic stability.

What Is the Minimum Wage in Canada in 2025?

In Canada, the minimum wage in 2025 varies across provinces and territories – from as low as $15.00 in Saskatchewan and in Alberta to as high as $19.00 in Nunavut (as of May 1, 2025).

Minimum wage in Alberta

The general minimum wage in Alberta is currently $15.00 (effective as of October 1, 2018).

Basic rules for minimum wage in Alberta

- Employers must pay at least the minimum wage.

- The general minimum wage applies to all employees, except for students under 18, which receive a student minimum wage of $13.00 an hour.

- The minimum wage don’t include tips or expense money.

- Employees must be paid for at least 3 hours each time they go to work, even if they’re sent home early, unless the employee is not available to work the 3 hours.

These minimum wage rules are not exhaustive; ; learn more about minimum wage rules in Alberta.

Minimum wage in British Columbia

The general minimum wage in B.C. is currently $17.40 per hour (effective as of June 1, 2024).

Basic rules for minimum wage in British Columbia

- Different types of employees have different minimum wage rates.

- Minimum wage applies regardless of how employees are paid – hourly, salary, commission or on an incentive basis. Nor is it higher in cities with a high cost of living like Vancouver.

- If an employee’s wage is below minimum wage for the hours they worked, the employer must top up their pay so that it’s equal to minimum wage.

These minimum wage rules are not exhaustive; ; learn more about minimum wage rules in British Columbia.

Minimum wage in Manitoba

The minimum wage in Manitoba is currently $15.80 per hour (as of October 1, 2024).

Basic rules for minimum wage in Manitoba

- The minimum wage applies to all employees. It is not higher in cities with a high cost of living like Winnipeg.

- Employees who are paid incentives must earn at least minimum wage in each pay period. Employers must top up or add wages when an employee has not earned at least minimum wage in each pay period.

- Minimum wage rules differ for certain sectors of the construction industry.

- Youth under 18 years of age are not allowed to do certain types of work.

- Some groups of employees are excluded from minimum wage.

These minimum wage rules are not exhaustive; ; learn more about minimum wage rules in Manitoba.

Minimum wage in New Brunswick

The minimum wage in New Brunswick is currently $15.65 (as of April 1, 2025).

Basic rules for minimum wage in New Brunswick

- All employees paid by salary, commission and for piece work must receive at least minimum wage for every hour worked.

- There are special minimum wage rates for certain categories of employees in government construction work or staff at residential summer camps.

These minimum wage rules are not exhaustive; ; learn more about minimum wage rules in New Brunswick.

Minimum wage in Newfoundland and Labrador

The minimum wage in Newfoundland and Labrador is currently $16.00 (as of April 1, 2025).

Basic rules for minimum wage in Newfoundland and Labrador

- Employees do not have to share tips with an employer, manager or supervisor.

- Employers must pay employees not less frequently than half monthly.

- All wages owing must be paid within 7 days of the end of the pay period.

- Employers may deduct certain amounts from wages.

These minimum wage rules are not exhaustive; ; learn more about minimum wage rules in Newfoundland and Labrador.

Minimum wage in Northwest Territories

The minimum wage in Northwest Territories is currently $16.70 (as of September 1, 2024).

Basic rules for minimum wage in Northwest Territories

- Youth under 17 years of age may work the night shift or during school hours only with authorization from the Employment Standards Officer.

- Youth under the age of 16 are prohibited from working in certain jobs and environments.

- If an unscheduled employee is called into work, the employer must pay recall pay (wages at the employee’s regular wage), for a minimum of 4 hours.

- Employees are entitled to an unpaid meal break of at least 30 minutes after 5 continuous hours of work. Employers are not obligated to pay for this break unless they require employees to work or stay on the premises during this time.

- Employers are not obligated to provide coffee breaks.

These minimum wage rules are not exhaustive; learn more about minimum wage rules in Northwest Territories.

Minimum wage in Nova Scotia

The general minimum wage in Nova Scotia is currently $15.70 (as of April 1, 2025).

Basic rules for minimum wage in Nova Scotia

- Minimum wages differ, depending on industry category.

- If an employee is called in to work outside regular work hours, the employer must pay at least 3 hours of work at the minimum wage rate, even if the employee works only one or two hours.

- Employees must be paid at least minimum wage for all time spent at the workplace at the request of the employer, waiting to perform work.

- Minimum wage rules do not apply to certain categories of employees.

These minimum wage rules are not exhaustive; ; learn more about minimum wage rules in Nova Scotia.

Minimum wage in Nunavut

The minimum wage in Nunavut is currently $19.00 (as of January 1, 2024).

Basic rules for minimum wage in Nunavut

- Employees of all ages must receive at least minimum wage for all hours worked.

- Wages include all forms of remuneration for work performed, except tips and other gratuities.

- If an employer calls a worker back to work, and the recall was not scheduled in advance, the employee is entitled to a minimum payment of four (4) hours at their regular rate of pay, even if they don’t do any work.

- Employees under the age of 17 must obtain approval from the labor standards office to work; certain restrictions apply.

These minimum wage rules are not exhaustive; ; learn more about minimum wage rules in Nunavut.

Minimum wage in Ontario

The general minimum wage in Ontario is currently $17.20 (will increase to $17.60 on October 1, 2025). This is also the minimum wage in Toronto.

Basic rules for minimum wage in Ontario

- Different minimum wages apply for hunting, fishing & wilderness guides, and homeworkers.

- Young workers are paid a lower student minimum wage.

- If an employee’s pay is based completely or partly on commission, it must amount to at least the minimum wage for each hour the employee has worked.

- If an employee who regularly works more than three hours a day is called in to work but works less than three hours, the three-hour rule applies.

These minimum wage rules are not exhaustive; ; learn more about minimum wage rules in Ontario.

Minimum wage in Prince Edward Island

The minimum wage in Prince Edward island is currently $16.00 (will increase to $16.50 on October 1, 2025).

Basic rules for minimum wage in Prince Edward Island

- All employees must be paid at least the minimum wage.

- Employees are entitled to break periods during the work day and vacation with pay.

- Employees are entitled to a one half-hour unpaid break every five consecutive hours. If employees do not get the full half-hour break at one time or are required by the employer to remain on the premises during their break, the employer must pay for the half hour.

- An employer can make certain deductions from an employee’s pay.

These minimum wage rules are not exhaustive; ; learn more about minimum wage rules in Prince Edward Island.

Minimum wage in Quebec

The general minimum wage in Quebec is currently $16.10 (as of May 1, 2025).

Basic rules for minimum wage in Quebec

- The minimum wage rate is different for farm workers and tipped employees, such as those working in restaurants & bars.

- Commission-based and piece-rate workers must always receive at least the minimum wage for the work they perform.

- An employer cannot offer a different hourly wage to individuals performing the same tasks in the same establishment solely based on their employment status.

These minimum wage rules are not exhaustive; ; learn more about minimum wage rules in Quebec.

Minimum wage in Saskatchewan

The minimum wage in Saskatchewan is currently $15.00.

Basic rules for minimum wage in Saskatchewan

- Employees must be paid at least minimum wage, with some exceptions.

- Employees who report to work must receive at least three hours pay at their hourly wage, even if they work less than three hours (reporting for duty pay), with certain exceptions.

- Reporting for duty pay rules apply on public holidays, but not to overtime work.

- If an employer requires an employee to report to work to receive their lay-off or termination notice, the employee is entitled to reporting for duty pay.

- An employer must give an employee at least a 30-minute unpaid eating break. If the employee is required to remain on duty during their eating break, the employer must pay for the break.

These minimum wage rules are not exhaustive; ; learn more about minimum wage rules in Saskatchewan.

Minimum wage in Yukon

The minimum wage in Yukon is currently $17.94 (as of April 1, 2025).

Basic rules for minimum wage in Yukon

- Some categories of employees are exempt from minimum wage rules.

- Employers must keep accurate employee records and provide employees with a wage statement.

- Employers may not withhold, deduct or offset an employee’s earnings without their written authorization.

- Employers must give an employee at least one pay period notice if they intend to reduce the employee’s wages.

These minimum wage rules are not exhaustive; learn more about minimum wage rules in Yukon.

What Is Total Compensation and Why Is It Important?

Total compensation encompasses all forms of compensation and benefits that employees receive from their employer. This includes salary, bonuses, health insurance, retirement contributions, paid time off, and perks.

While salary is crucial, other benefits like workplace flexibility and work-life balance play a significant role in employee satisfaction. Many workers prioritize these non-monetary benefits, as they contribute to overall well-being and productivity.

Studies show that companies with comprehensive total compensation packages have higher employee retention and satisfaction rates, highlighting the importance of addressing both financial and non-financial needs in the workplace.

12 Tips for Making Minimum Wage Jobs More Attractive to Potential Employees

Here are some things business owners can do to make their minimum wage job offers more attractive to potential employees.

1. Emphasize Non-Monetary Benefits

Highlight non-monetary benefits such as flexible work schedules, opportunities for advancement, skill development programs, and a positive work culture.

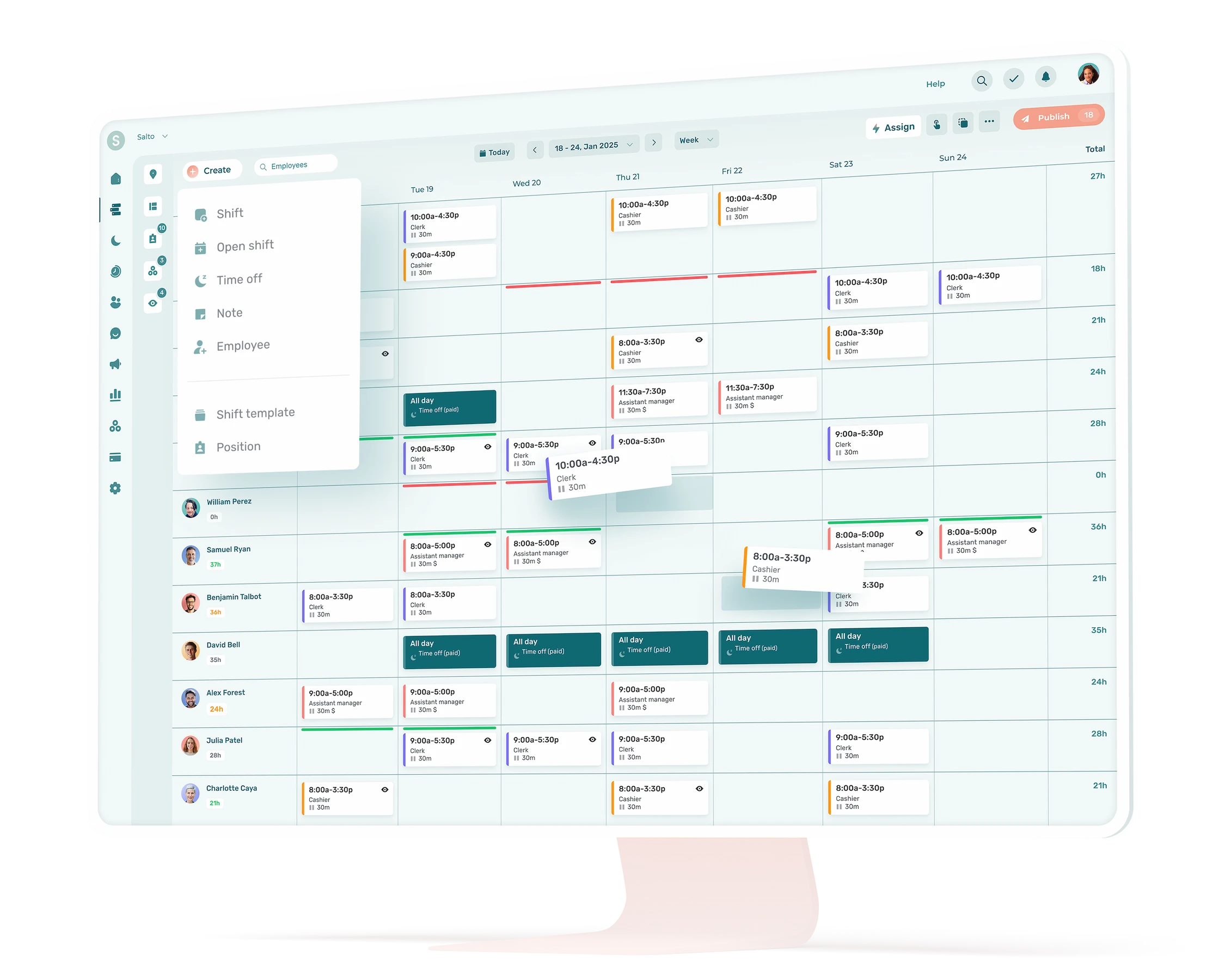

Quickly and easily build employee work schedules and share them with your team instantly, anywhere. with Agendrix Employee Recognition Software.

2. Offer Incentives and Rewards

Implement incentive programs or rewards for meeting performance goals, such as bonuses, recognition, or additional paid time off.

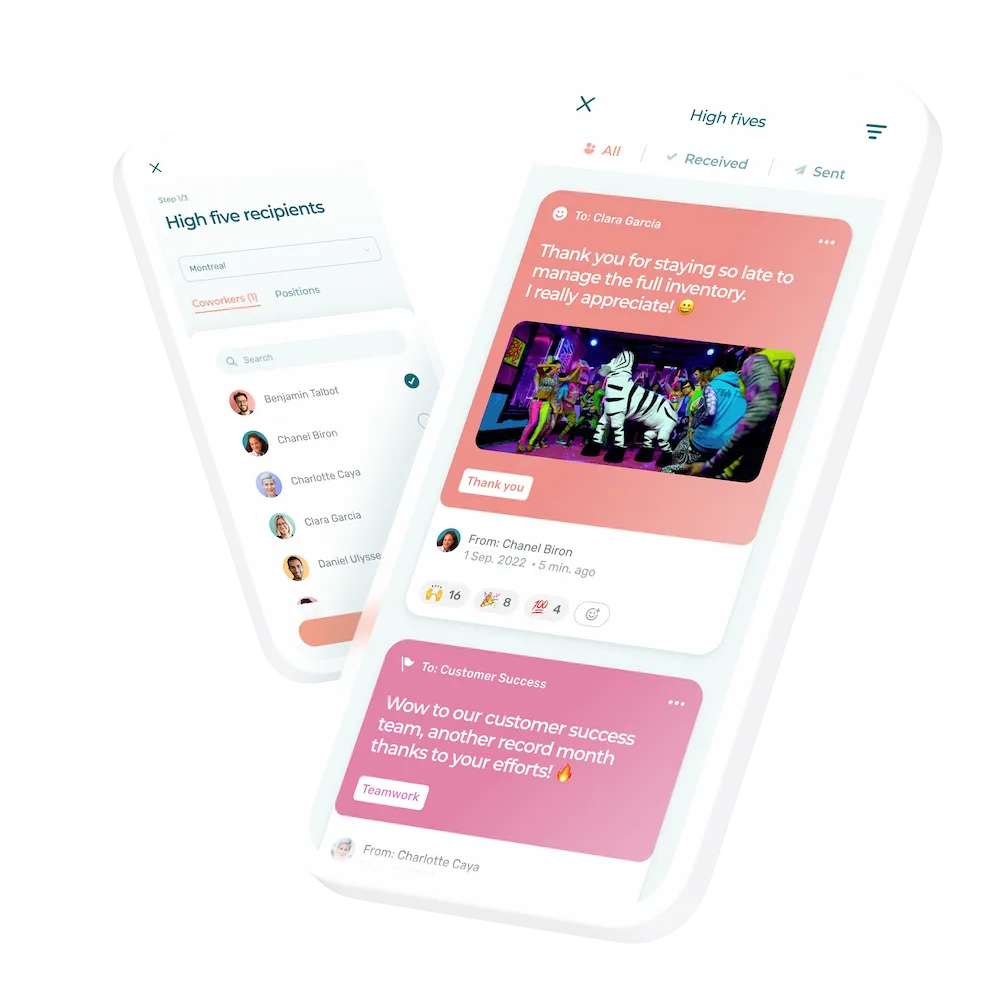

Let everyone exchange thoughtful messages of thanks, congratulations, or celebration in seconds with Agendrix Employee Recognition Software.

3. Provide Clear Career Pathways

Outline potential career progression opportunities within the company, demonstrating how employees can grow and advance over time.

4. Offer Training and Development

Invest in employee training and development programs to help your team enhance their skills and advance their careers, showing a commitment to their growth and success.

5. Create a Positive Work Environment

Foster a supportive and inclusive workplace culture where employees feel valued, respected, and motivated to perform their best.

6. Be a Good Manager

Good managers know how to coach, engage and motivate their teams, which leads to a more successful business.

Must-reads for becoming a more effective manager:

- What Is Caring Leadership, and Where to Begin?

- Situational Leadership, or How to Adapt to Your Team

- Emotional Intelligence at work: The Secret Weapon of Top Managers

- Active Listening : communication in the work place

7. Provide Opportunities for Feedback and Input

Encourage open communication and feedback from employees, demonstrating that their opinions and contributions are valued and considered.

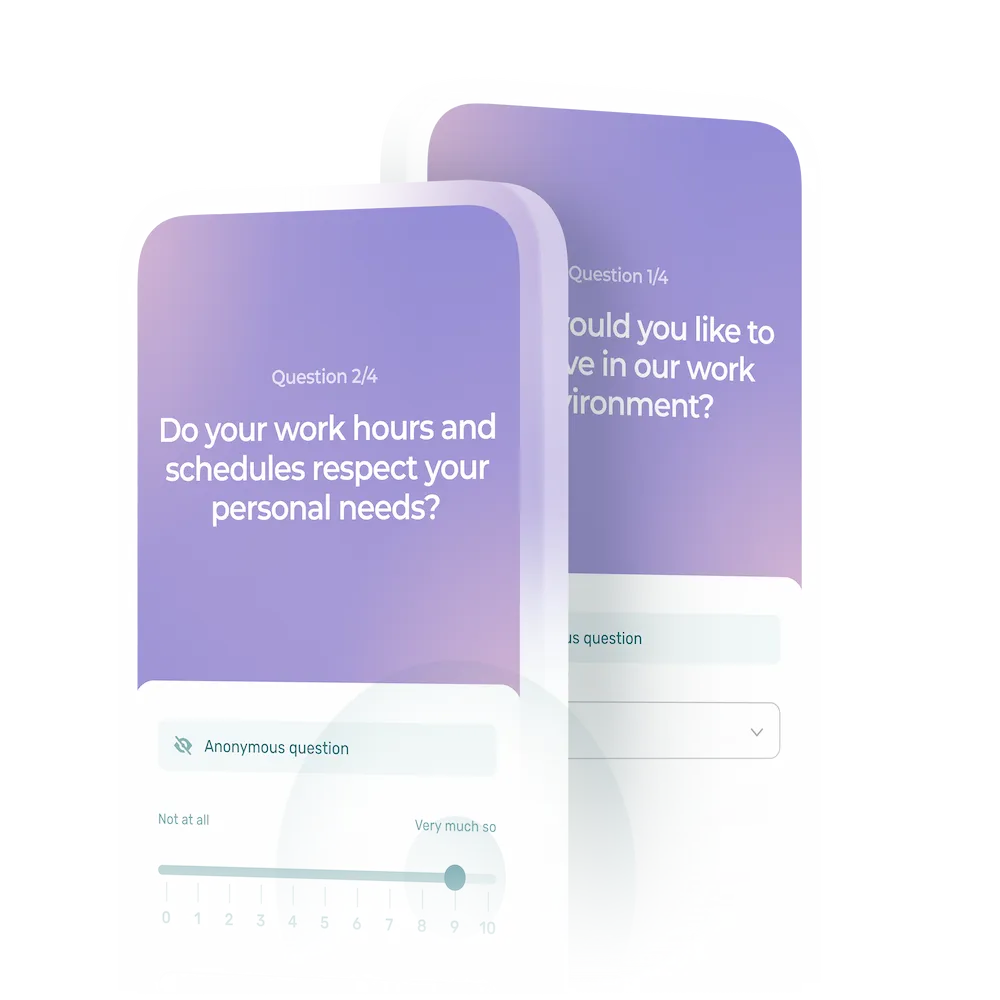

Easily build custom surveys and share them with your team instantly, anywhere with Agendrix Employee Survey Software.

8. Offer Additional Perks

Consider offering additional perks such as discounts on products or services, wellness programs, or employee assistance programs to enhance the overall employee experience.

9. Promote Work-Life Balance

Support work-life balance by offering flexible scheduling options, remote work opportunities, and paid time off for personal and family needs.

10. Highlight Social Responsibility

Showcase the company’s commitment to social responsibility and community involvement, appealing to candidates who value corporate citizenship.

11. Be Transparent and Honest

Provide clear and accurate information about job responsibilities, expectations, and compensation, fostering trust and transparency throughout the hiring process.

12. Offer a Great Employee Experience

Once you have attracted talented and motivated employees, retain them with a great employee experience.

Should You Mention Minimum Wage in Your Job Offer?

Advertising your minimum wage paying job can actually work in your favor. Studies show that companies that advertise pay receive up to 90% more applicants for their job offers. Depending on where your business is located, you may be legally required to adhere to pay transparency laws.

As of November 2023, pay transparency laws exist in:

- Newfoundland

- Prince Edward Island

- British Columbia

- Ontario is expected to pass this legislation soon

What Is the Minimum Wage in Canada?

There is no federal minimum wage in Canada; it varies by province and territory. Each province and territory sets its own minimum wage rate. Minimum wage increases can change over time due to government policies and economic factors. Some provinces offer a higher minimum wage rate than others.

Current Minimum Wage Rates Across Canada

- Alberta: $15.00 (Effective as of October 1, 2018)

- British Columbia: $17.40 (Effective as of June 1, 2024)

- Manitoba: $15.80 (Effective as of October 1, 2024)

- New Brunswick: $15.65 (Effective as of April 1, 2025)

- Newfoundland & Labrador: $16.00 (Adjusted annually on April 1, 2025)

- Northwest Territories: $16.70 (Effective as of September 1, 2024; adjusted annually)

- Nova Scotia: $15.70 (Effective as of April 1, 2025; adjusted annually)

- Nunavut: $19.00 (Effective as of January 1, 2024)

- Ontario: $17.20 (Will increase to $17.20 on October 1, 2025)

- Prince Edward Island: $16.00.

- Quebec: $15.75 (Effective as of May 1, 2025)

- Saskatchewan: $15.00 (Effective as of October 1, 2024)

- Yukon: $17.94 (Effective April 1, 2025; adjusted annually)

Which Province Has the Highest Minimum Wage?

As of April 9, 2024, the territory of Nunavut has the highest minimum wage in Canada, at $19.00 per hour. This minimum wage rate has been in effect since January 1, 2024.

Which Province Has the Lowest Minimum Wage?

The province with the lowest minimum wage in Canada is Saskatchewan and Alberta, at $15.00 per hour. This minimum wage rate has been in effect since October 1, 2024 and October 1, 2018.

How Is the Minimum Wage Determined?

In Canada, each provincial and territorial government sets its own minimum wage rates based on factors like cost of living and economic conditions. These rates aim to ensure workers receive a living wage.

How Often Does the Minimum Wage Change in Canada?

The frequency of minimum wage changes in Canada varies depending on each province and territory. Some review and update their minimum wage rates annually; others, less frequently. Changes to minimum wage rates can also occur in response to legislative changes or government policies.